High-performance PCIe 4.0 SSDs are soaring past 30 TB, and spinning hard drives are hitting 20 TB for a cheaper alternative to cope with the escalating growth of data as 2020 draws to a close.

Chip manufacturers also continued to push the envelope with denser 3D NAND flash that can help users lower the cost per bit and reduce their storage footprints. Micron unveiled its 176-layer 3D NAND in November at the Flash Memory Summit, although it disclosed no timeline for availability. In December, SK Hynix announced that it provided controller companies with samples of its 176-layer, 512 Gigabit triple-level cell (TLC) flash, which it calls “4D NAND.”

At year’s end, Intel launched PCIe 4.0-based D5-P5316 SSDs built with its 144-layer quad-level cell (QLC) 3D NAND that can store four bits per cell. The D5-P5316 is due in the first half of 2021 at capacities up to 30.72 TB. Earlier in the year, Intel added lower-capacity single-port PCIe 4.0 options, the D7-P5500 and D7-P5600, built with 96-layer TLC 3D NAND.

PCIe 4.0 SSDs make inroads

Low-latency enterprise PCIe 4.0 SSDs emerged in late 2019, when Samsung unveiled its PM1733 and PM 1735, with a 30.72 TB model available upon request. Kioxia followed suit in 2020, with its CM6 offering up to 30.72 TB with single- and dual-port options. Samsung and Kioxia claim tests show their PCIe 4.0 SSDs hitting at least 1.4 million IOPS for random reads and 7 GBps for sequential reads.

But Intel claimed to have the “world’s fastest data center SSD” with the P5800X, which it launched this month. The P5800X uses second-generation 3D XPoint memory that Intel developed with Micron to fill the gap between slower and less-expensive NAND flash, and faster and higher-priced DRAM. Intel sold off its NAND flash business to SK Hynix in October to concentrate on AI, 5G networking, edge computing and its 3D XPoint products, which it brands as Optane.

Micron in late 2019 said its first-generation 3D XPoint-based X100 was the fastest SSD, delivering 2.5 million IOPS for data reads and more than 9 GBps of read-write throughput in tests. But Intel claims the new P5800X supports PCIe 4.0 and tests out at 4.6 million random-read IOPS and 7.2 GBps in sequential-read throughput to boost performance over its PCIe 3.0-based P4800X predecessor.

Target uses for PCIe 4.0 SSDs

PCIe 4.0 SSDs double the bandwidth of PCIe Gen3 drives to target the most demanding workloads, including analytics, AI, machine learning and financial trading applications. But they require servers with processors that support the PCIe Gen4 technology. So far, the main option has been servers equipped with AMD’s Epyc CPU. Intel has yet to disclose when its server processors will support PCIe 4.0.

Swapna Yasarapu, senior director of SSD product marketing for data center devices at Western Digital (WD), said many customers still use slower SAS and SATA SSDs, and even PCIe Gen3 SSDs can improve performance by a multiplier of two to five times. In July, WD shipped its highest-performing drive for cloud and data center workloads, the PCIe 3.1-based Ultrastar DC SN840. WD claimed the SN840 reached 780,000 IOPS for random reads and sequential throughput of 3.5 GBps for reads and 3.3 GBps for writes in tests.

Kioxia pushed the limits of SAS in 2020 with its new PM6 Series SSD supporting 24 Gbps technology, rather than the 12 Gbps options offered in the past. Kioxia said customers requested write-intensive drives, so the PM6 supports 10 drive writes per day. Kioxia’s data sheets list the PM6’s sequential read performance at more than 4.3 GBps.

64 TB SSD from Nimbus Data

At the lower end of the SSD performance spectrum, Nimbus Data released SAS- and SATA-based 64 TB 3.5-inch SSDs that it built with dense QLC flash to replace HDDs. At $170 per TB, the ExaDrive NL 64 TB SSD costs more than HDDs, but Nimbus claims customers can realize savings in power, cooling and rack space.

Other ultrahigh-capacity QLC SSD options available in storage systems include Pure Storage’s 49 TB DirectFlash modules and IBM’s 38.4 TB FlashCore modules, which both support PCIe and NVMe for higher performance. But unlike the Nimbus 64 TB ExaDrive NL SSD, the IBM and Pure flash modules are designed for use only in their storage systems.

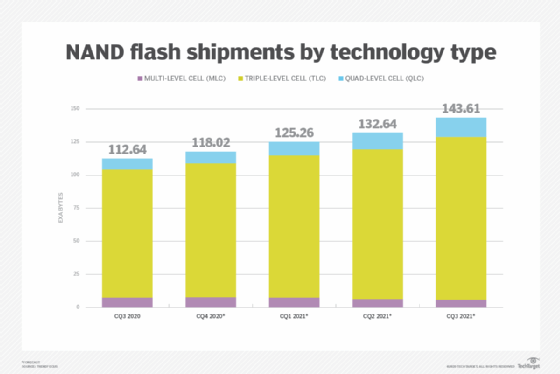

Although flash manufacturers are coming out with new QLC SSDs that can help lower costs, the drives remain a low percentage of overall total shipments. Don Jeanette, a vice president at Trendfocus, estimated that QLC accounted for only 7.2% of the 112.6 exabytes of NAND shipments in the third quarter, with TLC at 85.8% and two-bits-per-cell multi-level cell (MLC) flash at 7.0%.

New form factors also continue to emerge from SSD manufacturers. Vendors sampling new E1.S SSDs that support the Enterprise & Datacenter SSD Form Factor include Intel, Kioxia, Samsung and startup Fadu Technology. E1.S SSDs are seen as a replacement for gumstick-shaped M.2 SSDs that many hyperscalers use in servers, because they offer higher density and hot-plug capability to enable them to replace drives while the system is running.

Computational storage drives equipped with processors to enable compute services also got a new E1.S option in 2020, when NGD Systems added a 12 TB SSD. But Trendfocus’ Jeanette said he doesn’t expect E1.S SSDs to ramp up in volume until 2022 or 2023.

Meanwhile, Western Digital advanced the Zoned Storage initiative that it launched in 2019 with a new 2.5-inch Ultrastar DC ZN540 SSD. Zoned Namespaces SSDs write data sequentially to discrete regions of the drive to boost performance and usable capacity. Western Digital claimed its ZN540 could improve performance by 4x and quality of service by 2.5 over conventional SSDs. The Ultrastar SSD is sampling to select customers, but application support for Zoned Storage is still in the development stage.

NAND flash chip prices have been trending downward in the second half of 2020, offering the potential to also lower costs for enterprise solid-state drives. But SSDs still cannot match the price per GB of hard disk drives (HDDs) for enterprises and hyperscalers in need of mass storage.

All three HDD manufacturers — Seagate, Toshiba and Western Digital — have worked on microwave-assisted magnetic recording (MAMR) and heat-assisted magnetic recording (HAMR) technologies to overcome the challenges associated with recording data reliably at increasingly high drive densities.

The new 20 TB Ultrastar DC HC650, with shingled magnetic recording, and 18 TB Ultrastar DC HC550, with conventional magnetic recording, that Western Digital began shipping in 2020 use energy-assisted MAMR recording heads. By year’s end, Seagate began shipping 20 TB HDDs, built with HAMR technology, to select data center customers.

Other new HDD technologies to boost performance at higher areal density and capacity include Western Digital’s triple stage actuator and Seagate’s MACH.2 multiactuator technology.